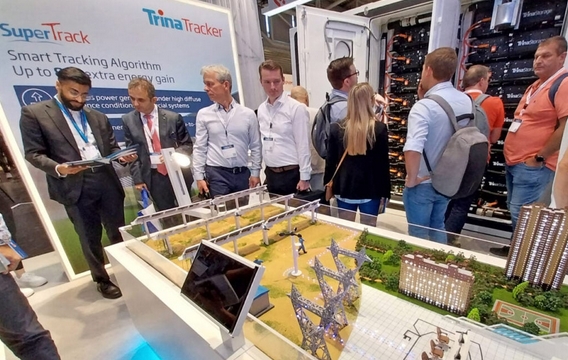

“Everyone is looking at solar as a fast-growing industry,” said Helena Li. Image: Trina Solar.

Leading Chinese module manufacturer Trina Solar has enjoyed a productive few months, with the company’s module shipments exceeding 65GW in 2023. However, with the global solar industry facing a downturn, and many manufacturers facing questions about the financial viability of their operations, the future of the industry as a whole is challenging.

Last month, PV Tech spoke with Helena Li, Trina Solar executive president, at the Intersolar Europe 2024 event in Germany, about recent changes in the global solar industry, and how Trina is looking to ensure efficient and effective operations amid this uncertainty.

PV Tech: How has the global solar industry grown in recent years?

Helena Li: Solar has grown quite steadily, but in the last two or three years grew faster – especially after Covid-19 and when the Ukraine mattered happened, and electricity price shot [up] and the oil price [was] high – growth in 2022-23, compared to the year before, was around 80% globally. And then the year before it was 60%; you’ll never find an industry grow 60-80%.

In 2022, the cost of solar energy became the cheapest among all energy sources, which drove the whole thing to change. Previously, if you look at solar, starting in Europe, this was driven by policy, or by subsidies. It was really the feed-in tariffs, and a lot of compensated subsidies by the governments to encourage you to have solar. After 2022, you saw, across the whole world, you don’t need to subsidise solar, because it’s already cheaper than coal.

Before that, a lot of energy companies still held on to coal – in countries such as Australia and Singapore – compared to Europe; Germany was the first country to move to more renewables, and that’s because of high FITs and electricity prices. That’s a fundamental change in solar, and now everybody is switching; even the traditional oil companies have renewable sections, that are growing bigger and bigger.

Do you expect this rate of growth to continue? What challenges does the solar industry have to face?

Everyone is looking at solar as a fast-growing industry. There’s a lot of investment and entrepreneurs who are rushing into solar; but there are other issues, such as grid [capacity], and storage is still so expensive. Europe’s storage has not yet picked up. If you look at Vienna, one year they have renewables, but one year they cannot because of the grid. Grid infrastructure became the main issue for the US also, [where they have] about a 10GW bottleneck yet to be connected. Here it’s better, but here you can see it’s [growing] slowly as they look to add storage, and C&I and residential solar.

The second [challenge] is transmission, [and] high-voltage transmission from the big utility side of solar to the populated, high electricity consumption regions. Third is the installation. If you look at Europe; even if you have panels, you don’t have installers. Labour and installation capacity is an impact. From now to the next couple of years, there is probably only a 10% growth [rate].

How has the appetite for solar products changed in recent years?

There are still so many people rushing [into solar]. I think solar’s annual installations, or shipments, are around 400GW; it’s huge, it’s double what it was in China and India. I think what we see in these markets, where the grid is still an issue, the penetration of solar is comparably small, they will grow faster, around 20%. But in mature markets, where renewables already have a higher percentage, there will probably only be single digit [growth] or 10% [growth].

It’s good to attract so much attention, as it means people are thinking about solar. But in another way, with all these people thinking about solar from other industries, they’re probably thinking about how to utilise solar, how to introduce solar to their industry, instead of coming to solar to make panels. I think it’s good when it attracts interest, and because solar is so common now, that’s the main industry shift.

Even from last year to this year, there’s a more than 30% price drop in the last six months. It’s hurting all the margins and all the value chains [including] installers, distributors [and] importers. I think the last downturn was eight quarters, and hopefully this downturn, because it’s so big, and hitting even more fiercely, will last [until] the end of this year.

Do you think the market will stabilise in the coming years?

[The downturn] will cool down the current gold rush, and make sure that the industry is healthy. And, as is the case in other industries, there shouldn’t be so many players, hundreds of players. There will be consolidation. There are so many people suddenly coming into the market, with low prices, so hopefully we will cool down with the investors’ and financiers’ backing.

Many of these new players also don’t have technology or research and development (R&D) commitments; they don’t even have IP patents, [compared to] a company like us, that’s been around for 27 years – our European office has been here for 17 years – and has a long commitment. We have a lot of patents and can gradually build up the protections.

I think the downturn is a good time; the bigger ones, and the stronger ones, will get stronger and will wash out the non-competitive, low-quality players who are here for the short-term, or have been here for two or three years in the industry.

How will the implementation of new technologies affect the industry?

One good thing that has happened is that the n-type technologies have driven efficiency and costs to be even more effective. So the biggest and strongest ones can have these technologies installed, and it’s a good time to build up your skills and make preparations for the next great innovations and growth.

If competition is fierce, you know you have to have more focus on innovation, and you have to be really different from the normal players, who are just building something to survive, so only the strongest people with innovation and capabilities, like us, can survive in a sustainable [way].

We also look at this industry [and ask] if we can have a niche product. Solar is something where people are looking at returns [on investment] – in the past people are looking at mass production and the most cost-effective technology – but there is 5% or 10% of the industry where we have smaller niche markets. In Europe we have all black technology, and low-carbon requirements in the French markets. But those markets cannot lead the whole industry to progress that big.

How have you sought to optimise your operations across your supply chain?

It’s fast-growing, compared to other industries, but the efficiency and conversion rate is still very low – 22% or 23% for some of these panels – so technology and innovation can really bring solar to a [high efficiency] factor. Innovation in niche markets is a way, but in Trina, for example, when we shifted to 210mm panels, we wanted to have the best efficiencies per square millimetre. Second, we wanted to maximise the module space.

Third, we wanted to maximise the 40ft container space to 99.6% or 99.8%, so you can hardly squeeze a finger into it. As logistics costs are so high right now – with module costs going down, logistics costs are the highest, bigger than labour – and we cannot expect container sizes to change, so we need to maximise [the space]. This is innovation; maximising the wafers and ingots [too] so there’s less waste and maximising the logistics.

The second differentiation we have in solar is that we are the only supplier with a house full of all kinds of products, which runs from modules to trackers and storage, cleaning robots and hydrogen. All this is because we want to make sure, at a system level we can find more ways to improve efficiency. For the customer, we want to make installation time [shorter] and [improve] life cycle management, so if you have all these components and hardware together, you can have more integration.

(The above content is reproduced from pv-tech,By PV Tech)

Disclaimer: This website reproduces information from cooperative media, institutions or other websites. The publication of this article for the purpose of transmitting more information,and it does not imply endorsement of its views or confirmation of the authenticity of the content. All information on this website is for reference only and can’t be used as the basis for transactions or services. If there are any infringement or other issues in the content of this website, please notify it in time, then this website will be promptly modified or deleted. Anyone who logs in to this website in any way, or directly or indirectly uses the information on this website shall be deemed to have voluntarily accepted the binding of this website statement.