“Solar manufacturers in America are operating well below their full potential because the government is facilitating an over-reliance on China,” said SEMA Coalition executive director Mike Carr. Image: SEG

The Solar Energy Manufacturers for America (SEMA) Coalition has published a report into the US’ reliance on Chinese-made modules, calling for a “strengthening [of] the domestic supply chain to produce solar components”.

The report assesses current US silicon solar manufacturing capacity and identifies “glaring gaps” in local production of modules, wafers and cells.

The coalition consists of a number of non-Chinese solar manufacturers that are interested in the US manufacturing space, including First Solar, Meyer Berger and Silfab Solar.

The latest figures from Solar Media head of research Finlay Colville suggest that Chinese-owned PV companies supplied just over half of all PV modules shipped into the US in 2023.

A group of US senators recently urged the Biden Administration to increase tariffs on Chinese-made PV module, cell and wafer imports, claiming that the sustained risk of low-cost Chinese modules has threatened to “destroy” US-based solar manufacturing.

The SEMA Coalition notes that much of the US’ manufacturing deficiencies are tied to the ingot and wafer subsectors in particular. The report notes that the US currently has 20GW of annual crystalline polysilicon production capacity, but no ingot and wafer manufacturing capacity, a sharp decline since 2014, when the US had 500MW of such annual capacity.

As a result, attempts to relocate the manufacturing sector to the US have been fundamentally flawed. The report notes that the US is on track to have ample cell and module capacity – if just half of the US’ announced cell and module manufacturing capacity is brought online by 2027, US developers will be able to meet almost all of the country’s demand for cells and modules – but a lack of ingot and wafer production capacity means even this move to expand US manufacturing will remain heavily reliant on overseas products.

Much of the US’ reliance on Chinese-made modules stems from the fact that such modules are far cheaper to produce than their US equivalents, with the SEMA Coalition noting that, even today, US-made modules can be 30-50% more expensive to produce. However, the coalition suggests that now, the combination of the looming threat of complete Chinese dominance of the sector, and growing US policy support for domestic manufacturing, means there is a much stronger case for US manufacturing than ever before.

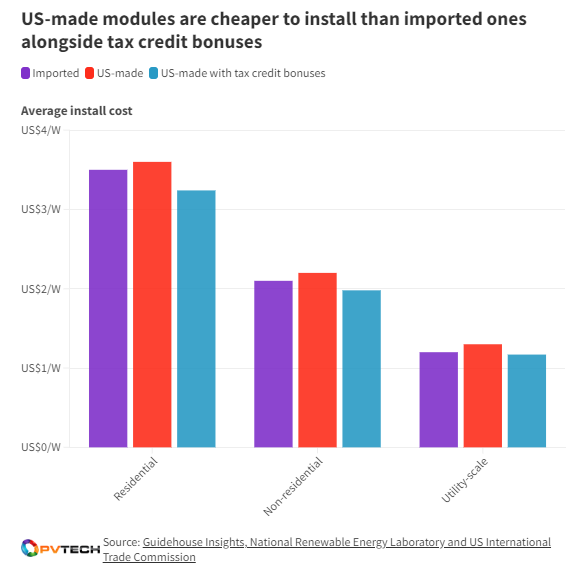

The graph below demonstrates what the SEMA Coalition calls the “effective” installation cost of US-made panels versus those imported from overseas across a number of solar sectors. While imported modules remain cheaper than US-made ones on the surface, the coalition notes that, if considered alongside supportive policy such as the tax breaks offered in the Inflation Reduction Act (IRA), installing US-made modules can actually be marginally cheaper than using those made elsewhere.

These figures highlight the potential positive impacts of supportive legislation for the US solar sector, and the SEMA Coalition report urges the government to strongly enforce its legislation. Most notably, the coalition draws attention to the anti-dumping and countervailing duty (AD/CVD), and calls on the government to “close gaps in US AD/CVD enforcement efforts for solar”.

The duty has received considerable attention in recent months, with a waiver from President Biden on the tariffs, imposed on imports from southeast Asian countries including solar products, being challenged in court by US manufacturer Auxin Solar. The coalition estimates that this waiver, effectively suspending the duties for a number of imports to which the duties should apply, meant that effective duty rate for imported solar modules in 2023 was 0.4%, down from 9.6% in 2021.

The years-long legal battle demonstrates the delicate balance that the government needs to strike between ensuring enough imports to meet the US’ solar demand, while not flooding the market with imported goods to such an extent that US manufacturing is entirely pushed aside.

The SEMA Coalition makes a number of policy recommendations for the future of the US sector, and uses the Covid-19 pandemic as an example of external factors that, if not properly responded to, could do significant damage to the US solar sector. In the wake of the pandemic, the US solar workforce shrank by 38%, driving a 37% decline in US solar installations and a loss of around US$3.2 billion in economic investment, five years’ worth of lost investments endured in the first two quarters of 2020 alone.

Many of these lost opportunities could impact employment in the US solar sector in particular. The report highlights a study conducted by the University of Louisiana at Lafayette on behalf of First Solar, a US company that Colville forecast to be “the only profitable” PV manufacturer in 2024, which found that the company’s operations in 2023 supported 16,245 jobs and helped generate close to US$1.6 billion in labour income for the US economy.

Ultimately, the report’s authors are keen to stress that the government should be doing more to enforce the legislation it has imposed, and protect both US workers and the economy from the current state of affairs.

“Solar manufacturers in America are operating well below their full potential because the government is facilitating an over-reliance on China and failing to provide a level playing field to help fuel investment and innovation,” said SEMA Coalition executive director Mike Carr.

“The Creating Helpful Incentives to Produce Semiconductors (CHIPS) Act and the IRA were game-changing in the tools they provided to the administration, but they must use the tools to their full effect to break China’s monopoly by onshoring the entire solar supply chain.”

(The above content is reproduced from pv-tech,By JP Casey)

Disclaimer: This website reproduces information from cooperative media, institutions or other websites. The publication of this article for the purpose of transmitting more information,and it does not imply endorsement of its views or confirmation of the authenticity of the content. All information on this website is for reference only and can’t be used as the basis for transactions or services. If there are any infringement or other issues in the content of this website, please notify it in time, then this website will be promptly modified or deleted. Anyone who logs in to this website in any way, or directly or indirectly uses the information on this website shall be deemed to have voluntarily accepted the binding of this website statement.