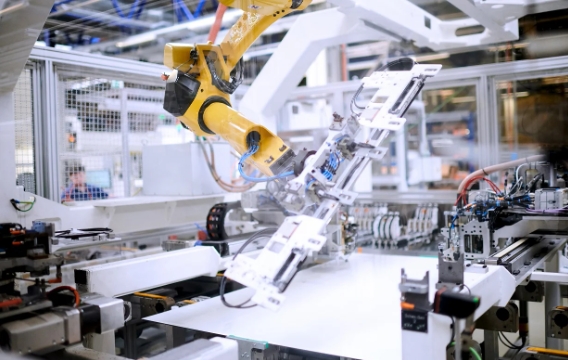

Low module prices from overcapacity have boosted solar deployments, even as they imperil some manufacturers. Image: Meyer Burger.

Low solar module prices kept solar PV competitive in the energy market in 2023 despite generally falling electricity prices, according to the latest Photovoltaic Power Systems Programme (PVPS) snapshot report from the International Energy Agency (IEA).

The high power prices that fueled the solar expansion that the world saw in 2022—driven primarily by the war in Ukraine—levelled off in 2023. However, rather than lessening solar’s business case as the cheapest form of renewable energy, the dramatic decline in solar module prices—as well as favourable legislation in many countries—kept installations on track.

According to IEA data, between 407.3GWdc and 446GWdc of new solar capacity came online in 2023, bringing the cumulative global capacity to ~1.6TW. This is a dramatic increase on the 236GW of new capacity added in 2022.

Simultaneously, the overcapacity phenomenon, which began in 2022, only accelerated in 2023, leaving the market with roughly 150GW of PV module stock – larger than the 2023 US and EU markets combined. This was the main driver behind the reduction in module prices.

In the short term, at least, low prices are a boon for governments and companies looking to deploy solar modules. 2023 saw sustained low prices across the solar value chain from polysilicon to modules. The former has recently fallen again, leading to questions over the ability of poly manufacturers to stay afloat over the coming year.

China’s deployed solar grew at a rate of over 125% in 2023, installing a minimum of 235GW based on official reporting. Despite this, and sustained growth in the EU (39%) and US (57%) markets, global deployments were insufficient to keep up with the overcapacity.

The report said: “Oversupply of PV modules in 2023 has shed a light on the difficulties to align production and demand in a very versatile environment: while production capacities increased significantly in China, the global demand was framed by constraints in markets such as the USA, India, Korea, and Australia, not exclusively.”

Indeed, every action has an equal and opposite reaction; low prices and access to capacity, which prove desirable for developers, pose a real threat to parts of the manufacturing industry. Manufacturers outside of China or Southeast Asia face a relatively steep uphill battle in establishing sustainable operations and carving out market share.

Policies like the Inflation Reduction Act (IRA) in the US, Production-Linked Incentive (PLI) in India and, latterly, the European Solar Charter, have attempted to lessen the industry’s reliance on solar supply from China.

The PVPS report said: “The different disruptions of 2020 to 2022 (covid, geopolitical tensions around the world and pollution episodes in China) have highlighted the fragility of the PV value chain, at a time when governments are looking to increase generation from PV.

“Local manufacturing initiatives in Europe, the USA, India, Morocco or Saudi Arabia have continued to be discussed, however, given the scope of some of the intentions, it is a slow process.”

The EU recenty announced its Solar Charter to support domestic solar supply, however the European industry had already experienced a shakeout as manufacturers – most notably Swiss veteran firm Meyer Burger – announced their exit from the market as a result of ‘unsustainable’ imported module prices.

Aside from manufacturing and price dynamics, the PVPS report also covered the largest annual solar markets and segments.

Behind China’s mammoth PV installations, the EU was the second largest market in 2023, installing 55.8GW of PV capacity, followed by the US with 30GW. India (16.6GW), Germany (14.3GW) and Brazil (11.9GW) also led global capacity additions.

29 countries installed at least 1GW of PV in 2023, and 19 countries now have at least 10GW of total cumulative installed capacity.

Both utility-scale and rooftop PV grew in 2023, with around 45% of new capacity installed on rooftops.

The full PVPS report can be found here.

(The above content is reproduced from pv-tech,By Will Norman)

Disclaimer: This website reproduces information from cooperative media, institutions or other websites. The publication of this article for the purpose of transmitting more information,and it does not imply endorsement of its views or confirmation of the authenticity of the content. All information on this website is for reference only and can’t be used as the basis for transactions or services. If there are any infringement or other issues in the content of this website, please notify it in time, then this website will be promptly modified or deleted. Anyone who logs in to this website in any way, or directly or indirectly uses the information on this website shall be deemed to have voluntarily accepted the binding of this website statement.